Table Of Content

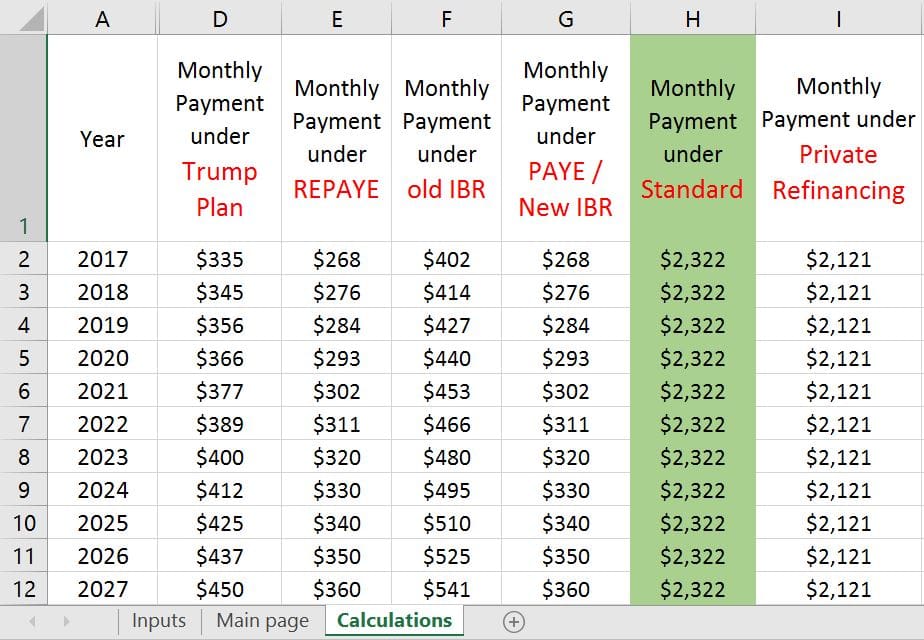

Here’s how to understand the results of what you entered into the loan calculator. These loans have interest rates that reset at specific intervals. They typically begin with lower interest rates than fixed-rate loans, sometimes called teaser rates.

Bond: Paying Back a Predetermined Amount Due at Loan Maturity

In a spreadsheet, show the first payment in row one, the interest payment in one column, the principal payment in the next column and the loan balance in the last column. A mortgage calculator can help you get a realistic idea of the type of home you can afford. The Rocket Mortgage calculator estimate shows principal and interest and has the option to include estimated property tax and homeowners insurance costs, based on your zip code. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. You start by paying a higher percentage of interest than principal.

Compare mortgage rates for different loan types

Oregon Mortgage Calculator - The Motley Fool

Oregon Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

It includes advanced features like amortization tables and the ability to calculate a loan including property taxes, homeowners insurance & property mortgage insurance. Typically, a fixed percentage based on the appraised value of your home that you pay to the county, the school district and the municipality where your property is located. The taxes may be assessed annually or semiannually, and you may pay them as part of your monthly mortgage payments. Depending on when you close your loan, some of this property tax may be due at the time of closing. A mortgage calculator helps you estimate your monthly payments.

Affordability calculator

When you use the Rocket Mortgage® calculator, it’ll factor in frequently overlooked costs like property taxes and homeowners insurance. The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes.

In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S. SmartAsset’s mortgage calculator estimates your monthly mortgage payment, including your loan's principal, interest, taxes, homeowners insurance and private mortgage insurance (PMI). You can adjust the home price, down payment and mortgage terms to see how your monthly payment will change. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts.

New Mexico Mortgage Calculator - The Motley Fool

New Mexico Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

Interest rate - Estimate the interest rate on a new mortgage by checking Bankrate's mortgage rate tables for your area. Once you have a projected rate (your real-life rate may be different depending on your overall financial and credit picture), you can plug it into the calculator. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet.

What to expect from mortgage rates in 2024

In other words, defaulting on a secured loan will give the loan issuer the legal ability to seize the asset that was put up as collateral. In these examples, the lender holds the deed or title, which is a representation of ownership, until the secured loan is fully paid. Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car.

Use the mortgage calculator to see what your payments will be like with both options. Then, consider how much you’ll pay in interest over the life of the loan. You can calculate your down payment as either a percentage or a flat dollar amount using the Rocket Mortgage calculator. Test out both options to get a better idea of how it will affect your home costs in the long term and the type of down payment you’ll need to bring to closing.

Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. By contrast, most domestic mortgages are set on what is known as a "term" rate – in other words, the borrower knows how much interest they will be paying for a set period of time. A 5/1 adjustable-rate mortgage has an average rate of 6.70%, an increase of 2 basis points from seven days ago. You’ll typically get a lower introductory interest rate with a 5/1 ARM in the first five years of the mortgage.

Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. In order to make an amortization schedule, you'll need to know the principal loan amount, the monthly payment amount, the loan term and the interest rate on the loan. Our amortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance. Your loan term and interest rate will remain the same, but your monthly payment will be lower. With fees around $200 to $300, recasting can be a cheaper alternative to refinancing.

No comments:

Post a Comment